From experience, it is clear that a business transfer cannot be limited to financial and legal aspects alone. Too often, a fundamental dimension is overlooked: the human factor. Behind every transaction lie stories filled with emotions, visions to align, and relationships to preserve. In our view, this human element is precisely what determines whether a transfer succeeds or fails.

The stakes are high, and addressing this issue is essential. The Observatoire du repreneuriat et du transfert d’entreprise du Québec (ORTEQ) estimates that Quebec will experience a wave of 50,000 business transfers by 20281. Yet, according to the Indice entrepreneurial québécois2 , only four out of 10 owners who plan to sell or transfer their business are prepared and have a succession plan in place3.

In this context, it is essential to better understand the pitfalls to avoid and the key steps to follow to maximize the chances of a successful business transfer. This is what we invite you to discover in this article, which emphasizes the human dimension, dialogue, and preparation.

Pitfalls to Avoid During a Business Transfer

1. Underestimating the Human Factor

We observe that the financial and legal aspects of transactions are prioritized and placed at the heart of succession efforts, at the expense of the human dimension of a transaction. This includes communication, vision, emotions, roles and responsibilities, expectations and performance management, skills development, and more. Yet the human dimension remains the leading cause of transfer failures.

It is therefore crucial to surround yourself from the outset with expertise in accounting, taxation, legal matters, human resources, organizational development, and sometimes even mediation. It is important to move away from the notion that no one knows your business, its challenges, issues, and ambitions better than you do.

2. Underestimating the Time Required

A thorough and rigorous process frequently takes more time than initially estimated. It is essential to ensure the best decisions are made, to allow room for error, sometimes to start over, to recruit new management team members, and so on.

Personal dimensions must also be considered, including objectives, financial security, and life events. Tax aspects also benefit from being discussed several years before the transaction, particularly in a family context.

All these elements sometimes require taking breaks or stepping back to move forward better. It therefore appears ideal to allow a minimum of three to five years, and ideally five to 10 years, to properly plan the transfer and ensure its success.

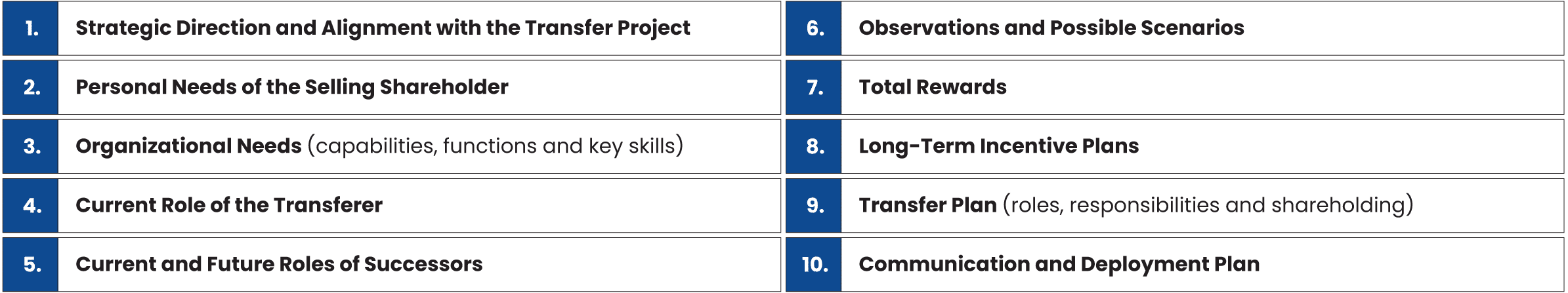

Key Steps to Follow in a Human-Centered Business Transfer Approach

1. Strategic Direction and Alignment with the Transfer Project

The first step is to verify that all stakeholders are aligned on the future of the business: the business strategy and market positioning, vision, mission and values, management culture, and so on.

It is also important to develop a shared vision and common understanding of the business transfer project. Align from the outset on what constitutes a successful succession, while including non-financial aspects such as employees, clients, and sustainability.

2. Personal Needs of the Selling Shareholder

The second step provides an opportunity to share and clarify the expectations, objectives, and needs of each party, particularly regarding time, money, and desired involvement following the transaction. This requires honest and authentic communication on both sides.

We emphasize the importance of sharing objectives and needs at the beginning of the process, even if the parties already have a strong and deep professional or personal relationship.

3. Organizational Needs

This third step involves documenting the capabilities (roles, responsibilities, positions), competencies (knowledge, skills, expected performance), and infrastructure (technologies, tools, processes) required to operationalize the business strategy, as discussed in our previous article: Long-Term Incentive Plans: How to Use Them to Support the Evolving Role of Managing Shareholders.

Cet exercice s’avère être une base essentielle afin de définir l’équipe idéale de repreneurs qui devra être mise en place pour assurer la continuité des opérations à travers et au terme du transfert.

4. Current Role of the Transferer

Fourth, it is important to document as comprehensively as possible the current role of the seller: expertise, skills, and key responsibilities. This exercise serves two essential objectives: first, to build the ideal successor team, and second, to build a solid transfer plan.

Indeed, it is not uncommon to see a seller leave with deep expertise, an important network, or strong leadership. There will therefore either be complementary profiles to add to the current successor team or a transfer to plan to limit risks and, above all, ensure continuity.

5. Current and Future Roles of Successors

At this stage, it is the successors’ turn to document their current pre-transfer roles, as well as their intended post-transfer roles, including interests, expertise, skills, and key responsibilities.

Special attention must be paid to distinguish each individual’s shareholder role from their operational role. These are two distinct hats to define, as separate compensation and expectations will be attached to each.

6. Observations and Possible Scenarios

The documentation from previous steps allows this sixth step to identify potential gaps between organizational needs and the skills and interests of the successors.

We can then build possible scenarios for the ideal team of successors and key people who will support them in the transfer.

7-8. Total Rewards And Long-Term Incentive Plans

In steps seven and eight, the total rewards package must be analyzed based on the determined roles of the successors, taking care to distinguish the shareholder role from that of operational expert.

Tax optimization of this compensation and a design tailored to the needs of successors and sellers will foster a message of goodwill and a favorable standard of living to develop full potential.

A long-term incentive plan can also be built to align the behaviors and interests of each party with collective success and the sustainability of the business. It will be important to define eligibility criteria in the case of implementing a long-term incentive plan for key people, as well as clear performance objectives to ensure ongoing alignment. This type of plan can serve as an important development area for the team, particularly regarding entrepreneurship and financial and tax literacy.

Moreover, mutual wealth creation will serve as a potential springboard for the final acquisition.

9. Transfer Plan

At this penultimate step, we will define the phases of the business transfer, including the gradual integration of successors, but especially their development and the support necessary for their success. This is achieved through a knowledge and responsibility transfer plan and an individual development plan.

At this stage, collaboration with legal and tax specialists is essential for the transfer of shares.

10. Communication and Deployment Plan

Finally, once everything is documented and planned, a successful and sustainable transfer can only come to fruition if a change management and deployment strategy is built. This will include key messages with high added value for all employees.

In Closing

The success of a business transfer does not rely solely on numbers or contracts; it depends above all on the ability to place the human element at the heart of the process.

By taking the time to plan each step, clarify roles, and foster authentic communication, it is possible to transform this challenge into a genuine opportunity for growth and sustainability.

Thus, business succession goes far beyond a simple transaction: it constitutes a human journey, full of meaning and continuity.

CONTACT US

Do you have questions about the key steps to follow in a people-centered business transfer process? Or would you like to discuss your situation? Fill out the form below to contact our team, we will be happy to discuss your needs with you.

1. Philippe Jean Poirier, Comment le Québec affrontera la nouvelle vague de transferts, Les Affaires, March 2025, https://www.lesaffaires.com/dossiers/repreneuriat-cedeurs-sortez-de-lombre/comment-le-quebec-affrontera-la-nouvelle-vague-de-transferts-edition_19_mars_2025/

2. Le Réseau Mentorat et La sphère – HEC Montréal, Y a-t-il un virage dans les tendances entrepreneuriales?, Indice entrepreneurial québécois, 2024, https://indiceentrepreneurialqc.com/

3. La Caisse, Transfert d’entreprise au Québec : seulement quatre propriétaires sur dix s’y préparent, Indice entrepreneurial québécois 2022, May 18, 2023, https://www.lacaisse.com/fr/actualites/communiques/transfert-dentreprise-quebec-seulement-quatre-proprietaires-dix-sy-preparent

Let's make an appointment

"*" indicates required fields

Partager