With a growing number of companies passing the torch in the next 10 years, many are beginning succession planning processes. This type of exercise is crucial for the sustainability of an organization, even for entrepreneurs who do not plan to sell their shares in the short or medium term.

Thus, in this article, we will examine the different reasons why an entrepreneur might consider a succession planning process as well as the total rewards strategies that will ensure optimal alignment between the aspirations of the managing shareholder and those of key resources.

Entrepreneurs, Are You Optimizing Your Involvement in the Company?

Fully dedicated to the growth of their business, entrepreneurs are often focused on optimizing processes and making their businesses profitable, leaving their hands immersed in operations. In some cases, their sense of accomplishment and entrepreneurial pleasure are affected by this reality.

To remedy this, the entrepreneur must take a step back to reflect on how he or she would like to see his or her role evolve:

- How can he or she optimize the use of his or her time and key skills in the organization?

- What new projects does he or she want to focus on, but due to lack of time, can’t do it?

- Is he or she able to take a vacation and disconnect 100%?

Thus, it is relevant to ask the following question: is the presence of the entrepreneur in daily operations essential to the success of the organization? Here are some avenues for reflection to answer this question:

- In the event of an absence, would the company’s operations be maintained?

- What is the unique knowledge or skills that are held exclusively by the managing shareholder?

The objective is not to relegate the managing shareholder to the background, but rather to plan a well-crafted succession in order to limit operational risks and allow the manager to focus on the places where he or she creates the most value for the company. In addition, operational independence has a positive impact on the market value of the company’s shares as well as on its long-term strength and sustainability.

Succession Planning Strategies and Effective Business Transition

In order to ensure a smooth transition of the shareholder’s role, it is possible to carry out a succession planning exercise to highlight the following elements:

| Required Capabilities | Required Skills | Required Infrastructure |

|---|---|---|

| Roles, responsibilities or positions you need today and in the medium term | Knowledge or skills sought in each role as well as expected performance | Tools, technologies, or processes you need to operationalize the business vision |

This exercise makes it possible to identify critical positions1, important positions2 and key positions3, and to find ways to support the transition of the managing shareholder.

A Strong Culture for Worry-free Delegation

Exiting operations is a significant step for a leader who has spent part of his or her life building and contributing to the success of his or her organization. This is why a company’s culture, values and management philosophy are at the heart of a successful transfer. Indeed, the identification of values and guiding principles, i.e. the behaviours expected by all employees in the organization, will ensure a smoother transition since the decisions made by the management team will be in line with the expectations and orientations conveyed by managers and shareholders.

Use of Long-Term Incentive Plans

LTIPs are frequently used as a means of retention in order to limit the risk of losing an employee in a key position. However, it is possible to maximize their effectiveness by using them as a lever to achieve the business vision, to ensure alignment of interests between key people and shareholders, but also to support a transition in a succession planning context.

Examples of situations where LTIPs could be used include, but are not limited to:

- Risk management: To mitigate the risk of an employee leaving a critical position1, plans that create an opportunity cost in the event of the employee’s departure can be considered. These programs, such as a bonus or retention bonus with payments spread over time, can engage and retain employees during the implementation of a contingency plan or knowledge transfer plan.

- Increased accountability without diluting the shareholding: Each entrepreneur may have his or her own personal reasons for not considering sharing the share capital of his or her business; for example: past bad experiences, legal, tax and administrative complexities, early family succession, etc. However, shareholding remains one of the most powerful levers for mobilization and loyalty since it allows you to share the organization’s increased value, to grant the right to pay dividends and to provide a great sense of belonging. There are other ways to share part of a company’s capital gain without diluting the shareholding, namely phantom shares. These fictitious shares or units capture an organization’s increase in value and then redistribute it as employment income to unit-holding employees at specific times. Combined with a profit-sharing program (to promote the distribution of excess liquidity), this type of program can be interesting in order to encourage some employees to think like shareholders, without diluting the shareholding. However, it is important to be aware that such a program requires available cash since the payments will ultimately be settled in cash (such as a salary). In addition, strategies exist to reduce the tax impact of the employee’s income taxation from phantom shares.

- High-potential employees: Some employees with exceptional potential will be expected to be able to exceed expectations in their current role and play a key role in the future of the organization. By choosing to build on their strengths and promote their professional development, it is possible to significantly increase their level of engagement. Taking the time to identify your high-potential employees will allow you to project yourself into the future and imagine who the contributors and visionaries of tomorrow will be. For these employees, the following strategies can be considered:

- Propose an accelerated development plan, combined or not with a loyalty program that progresses at the same pace as responsibilities;

- Encourage their participation in special projects and participate in the company’s influence, whether or not combined with a bonus plan spaced over time that will be triggered when short- or medium-term objectives are achieved.

-

Future successors and key employees: Some organizations wishing to engage more formally with their key employees, or with entrepreneurs whose aspirations lead them to engage in a business partnership, may consider long-term incentive mechanisms that affect the organization’s share capital, such as:

- Bonuses paid in shares;

- Stock option plans (ROAA);

- Direct shareholding;

-

Collective ownership programs, such as a worker-shareholder cooperative, employee trust, employee group trust, or an employee-owned management company.

To learn more about the employee group trust, we refer you to our article Long-Term Incentive Plan: Integrated Vision, Benefits and Key Success Factors

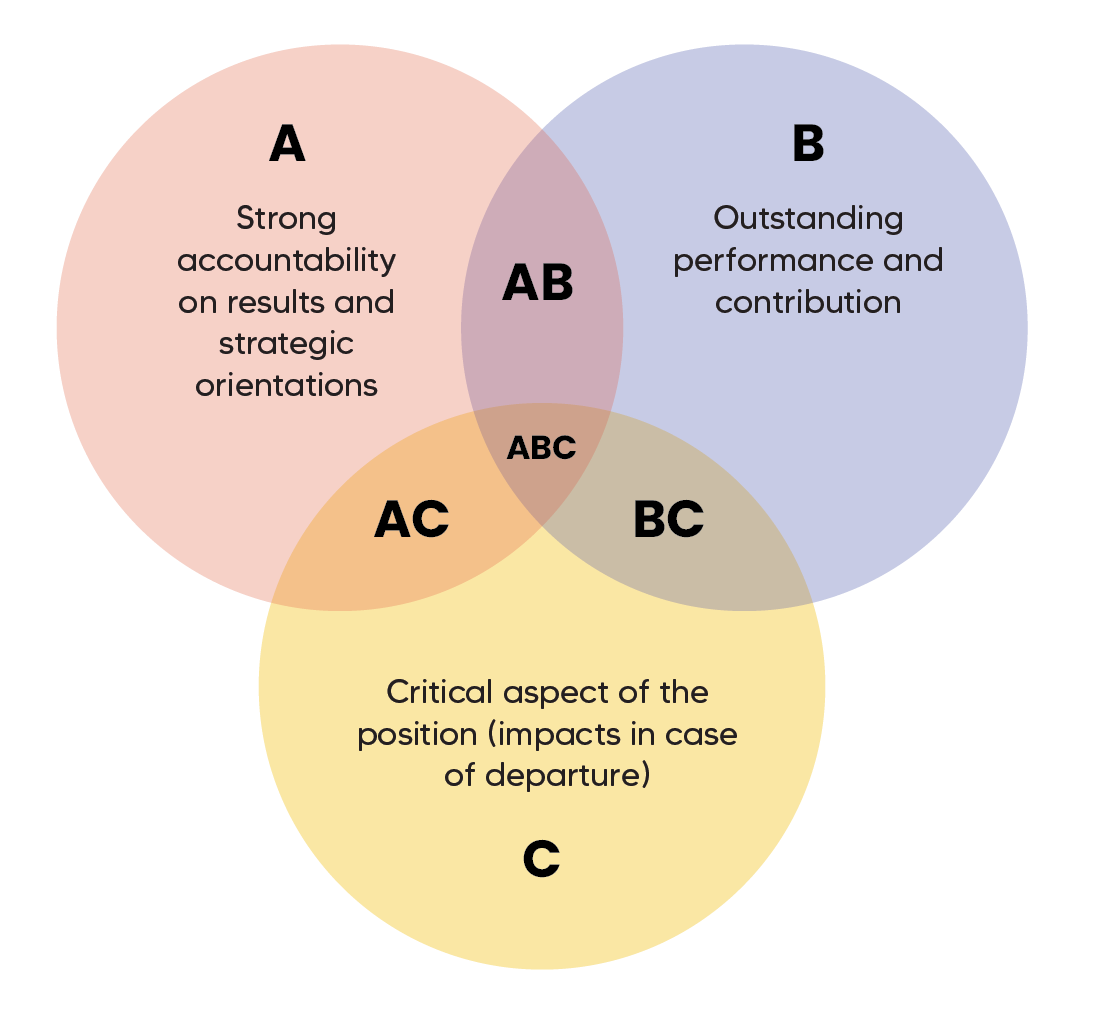

The following chart can help you identify and categorize your key employees and the impact they have on your organization:

In the presence of key employees (areas AB, AC, BC) or important employees (area ABC), plans that will allow them to become shareholders may be considered. More details are available on this subject in our article Long-Term Incentive Plan: Optimizing Your Return on Investment.

These mechanisms allow leaders to share business risk with their key employees, promote alignment of interests, and address their need for monetization (full or partial) if they want to reap the fruits of their labour while sharing in future growth.

Important Reflections to Make

It is important to note that many tax benefits are available for long-term incentive programs that involve the shares of local companies. However, the integration of key employees into the shareholding must be taken seriously, as this will entail minority shareholder rights and obligations for employees becoming shareholders, which can cause an additional challenge.

Thus, the way you choose to compensate your key employees can be scalable and include one or more of the mechanisms presented in our article. When implementing an LTIP, it is important to take into consideration the positive effect of having a key player who is motivated and aligned with the company’s objectives and increasing the company’s value. This will reduce the opportunity cost associated with sharing a company’s value or profits. More details on this subject are covered in our article Long-Term Incentive Plan: Integrated Vision, Benefits and Key Success Factors.

In closing, to successfully implement an LTIP, it is essential to clarify the company’s strategy and vision in order to align the interests of key employees with the common objectives of growth, valuation and sustainability. Taking into account the needs and aspirations of the major shareholder, a Long-Term Incentive Program can be designed to support both the company and the shareholder, whether in the context of a transition or sale, or simply to support the shareholder who wishes to focus on his or her natural strengths and on the projects that he or she has the most added value for his or her company.

Would you like to explore further? Contact us, our professionals in long-term profit-sharing plans remain available to answer your questions.

1. A position for which there are glaring risks or issues of departure, for example retirement, maternity leave, sick leave, etc.

2. A position encompassing responsibilities, tasks and activities that have a significant contribution to the achievement of the organization’s objectives.

3. A position that plays a critical role in the success and growth of the company.

Partager