This article was written in collaboration with Valérie Ménard, CPA, LL., M. Fisc., tax partner and member of the executive committee at the HNA firm.

The 2022 federal budget proposed the creation of the Employee Collective Trust (ECT) to encourage collective ownership of businesses and facilitate the transition of private businesses to employees. However, it was in the 2023 federal budget that changes to the Canadian Income Tax Act1 were proposed. While organizations using this shareholding model have existed in the United States for decades2, it is an emerging trend in Canada.

Considering that 76% of small business owners in Canada are considering selling within the next decade , the arrival of ECTs in Canada can only be welcomed.

In this article, we will cover the following elements to demystify ECTs:

- What are the operating modes, contexts of use, and advantages of an ECT?

- What are the main terms and conditions of an ECT?

- What are the limitations of an ECT?

- What are the next steps?

What are the operating modes, contexts of use, and advantages of an ECT?

ECTs are described by the government as a form of employee share ownership in which the shares of a company are held by a trust residing in Canada for the benefit of the employees of the company. In our recent articles “Long-Term Incentive Plan: Integrated Vision, Benefits and Key Success Factors” and “Long-Term Incentive Plan: Optimizing Your Return on Investment“, we include ECTs among the most popular long-term incentive plans.

The main objectives of an ECT are as follows:

- To hold shares of an eligible company3 for the benefit of employees, who are the beneficiaries of the trust;

- To make payments in their favour.

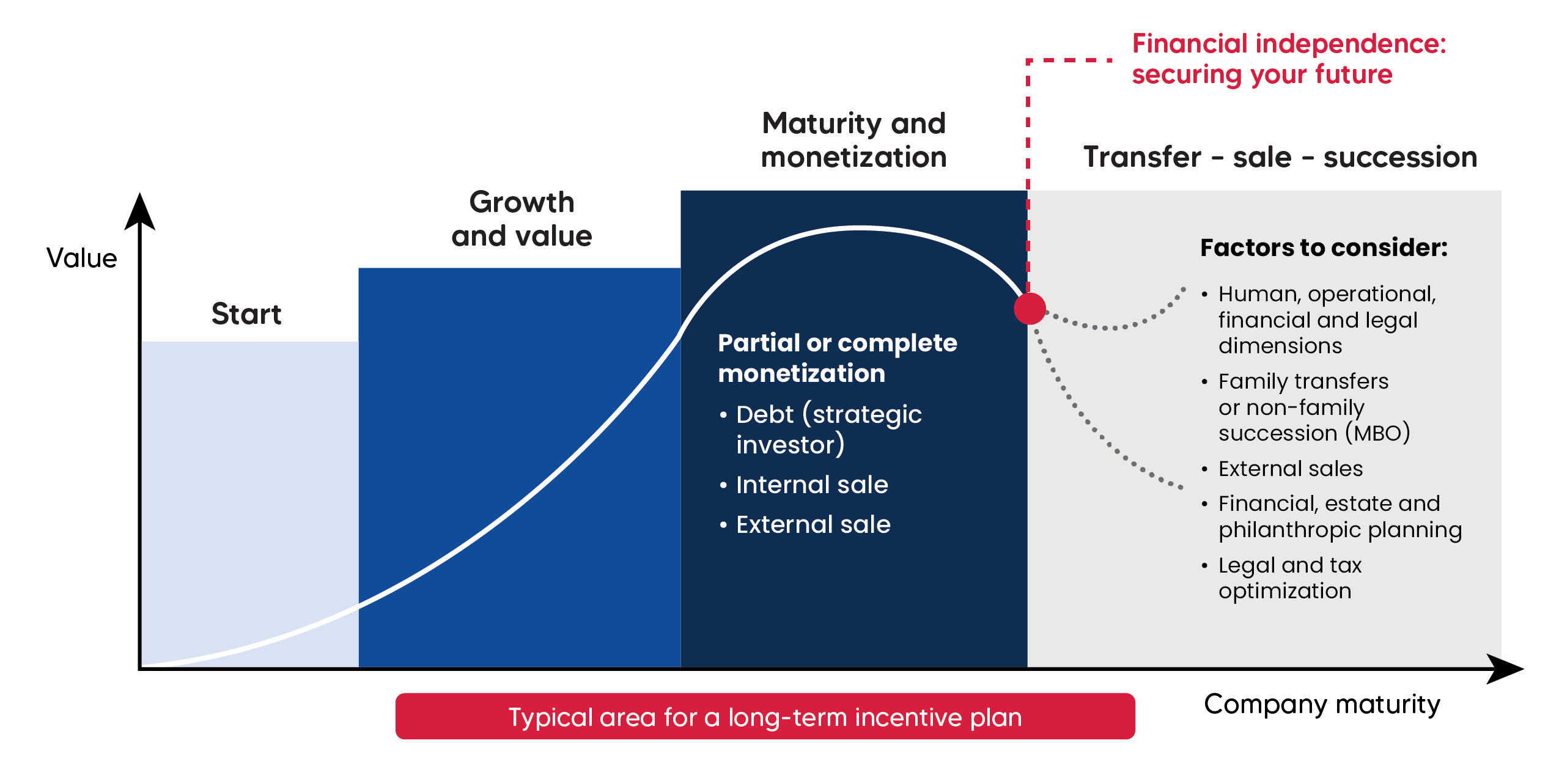

When a shareholder is in the transfer and monetization phase of the entrepreneurial life cycle (see infographic below), ECTs can be considered. In practice, the use of an ECT could allow, provided various conditions are met, access to attractive tax reliefs aimed at facilitating the financing of the transaction and encouraging outgoing owners to consider employee share ownership. A context of collective entrepreneurship, which involves a transfer of shares by a shareholder to several employees of their organization, promotes the use of this type of plan.

Entrepreneurial Life Cycle

Moreover, it is crucial that the leader truly believes in the vision of a collective takeover of their company to ensure its success. Implementing an ECT should not be seen merely as a financing mechanism for purchasing shares.

Here are the main advantages of using this mechanism:

- Allows employees to become indirect shareholders in the company without making direct payments;

- Increases employee participation in company decisions;

- Distributes a greater share of profits to employees;

- Facilitates access to a loan provided by the acquired company if its sole purpose is to facilitate the transfer of the business. The interest rate could also be lower than the prescribed rate without generating a taxable benefit for the acquiring person4;

- The seller can receive the sales price of their shares over several years, allowing them to spread the taxation over a maximum period of 10 years5;

- The possibility for the seller to exempt up to $10 million of capital gains realized from the sale of shares to the ECT, subject to certain conditions outlined in the federal budget presented on April 16, 20246; this incentive would be in effect for the years 2024 to 2026 inclusive. This can be a major advantage for the transferor!

What are the main terms and conditions of an ECT?

The following table provides a summary of the main terms to consider when setting up an Employee Collective Trust (ECT):

| Settlor |

To date, no specific requirements are provided for by the bill.

Therefore, the usual rules apply regarding the determination of the settlor7 of the trust. |

| Trustee |

One-third (1/3) of the trustees must be employees (employee trustees). |

| Beneficiaries |

The beneficiaries represent all employees of the company controlled by the ECT8.

Possible exclusion: employees who have not completed a probationary period of up to 12 months. There is a possibility to include former employees or their estate. A person related to the selling shareholder cannot be a beneficiary of the ECT, including the spouse, children, grandchildren, and siblings of the selling person. |

| Rights of beneficiaries |

Participation in the income and capital of the trust is governed by a principle of fairness.

The calculation of their participation will be based on one of the following criteria:

More than 50% of the beneficiaries must approve the following elements:

|

| Powers of trustees |

Actions must be taken for the benefit of all employees. Therefore, they cannot exercise their discretionary powers to act in the interest of one or a group of beneficiaries to the detriment of others.

Trustees will have an equal voting right in conducting the affairs of the trust. They must ensure that the purchase of shares by the ECT is done under conditions of full competition9. They must ensure that the ECT actually gains control of the company. |

| Deemed disposition | The ECT would not be subject to the deemed disposition of its assets every 21 years, as provided by the usual rules. |

What are the limitations of an ECT?

In light of the current Bill, several factors argue for a restricted use of ECTs at the moment. Here are a few:

- Since all employees must be beneficiaries of the ECT, it eliminates the possibility of a traditional Management Buy-Out transaction where only interested and carefully selected key individuals would access ownership in the company.

- In cases where family members of the selling shareholder are employees of the company, current measures10 require these individuals to leave their employment, which is a surprising condition. This problematic situation was brought to the attention of a representative from the Ministry of Finance who openly gathered feedback during the 2023 Congress of the Tax and Financial Planning Association.

- The ECT must hold a majority stake in the acquired company, meaning the selling shareholder can consider a gradual transfer of shares. However, they must be prepared from the outset to relinquish control of the company in favor of their employees.

- Considering the fact that beneficiaries must approve certain transactions, as mentioned in the previous section, and the degree of financial, legal and tax literacy of employees, it would be pertinent to offer employees appropriate training tailored to the business context, a professional development plan, or coaching to help them develop essential skills necessary for making informed decisions.

What are the next steps?

The proposed changes came into effect on January 1, 2024, but several uncertainties remain in practice, making it likely that the first ECT will not appear for several more months.

While the tax incentives associated with the use of ECTs are highly attractive, taxpayers will want to ensure they adhere to the conditions initially and over the long term. Deviating from the terms outlined in the ECT regime post-transaction could lead to retroactive application of standard rules and a loss of tax benefits granted to both the ECT and the selling individuals.

Furthermore, considering the additional complexities imposed by our provincial tax legislation, it is evident that the pioneer will not be established in Quebec, even though Quebec announced in June 2023 its intention to amend tax legislation and regulations to integrate ECT measures.

The Canadian Federation of Independent Business recommended ensuring that the structure of these trusts is simple and understandable. We hope that the coming months will achieve this commendable goal and resolve current uncertainties that could delay the adoption of ECTs in Canada.

Let’s remain optimistic and look forward to successful business transfers in favour of employee ownership in the coming years!

It’s worth noting that the rules have been simplified for the purpose of this article to facilitate understanding. Consulting with an expert in Total Rewards of Key Persons and a tax specialist is essential before proceeding with any action.

Thank you

We thank Valérie Ménard, CPA, LL.M. Fisc., Taxation Partner and member of the executive committee at HNA, for her high-quality contribution to the drafting of this article.

We’re here to help!

Whether it’s planning the transfer of your business or engaging your key people, our specialized team in long-term incentive plans is available to guide you towards the solution that best meets your needs.

Contact us now to begin shaping the future of your business while fully optimizing your compensation program to align with your business objectives.

1. Bill C-59, Economic Statement Implementation Act, 2023

2. According to a survey conducted in 2022 by the Canadian Federation of Independent Business (CFIB).

3. To qualify for this status, the company must be a Canadian-controlled private corporation. It must also meet certain conditions regarding its governance and the composition of its board of directors.

4. Interest must be paid within the first 30 days of the following year, and the loan must be repaid within 15 years following the purchase of shares by the ECT.

5. In the context of a sale that is not made in favour of an ECT, this maximum period is five (5) years.

6. If a disqualifying event occurs within 36 months following the transfer, the exemption will be retroactively denied. If this event occurs more than 36 months after the transfer, the ECT will be required to pay tax on a deemed capital gain equal to the eligible capital gain exemption amount.

7. The role of the settlor is to establish the trust and provide initial directions for its operation. Typically, the settlor is an individual.

8. According to the current text of the law. However, legislators seem open to relaxing this requirement. It will be necessary to monitor the evolution of this rule.

9. That is, under conditions reflecting the normal course of business in an open market that is not subject to any restrictions, where the parties to the transaction are well-informed, act prudently, have no interdependence, and neither party is compelled in any way to conclude the transaction.

10. It is provided that the beneficiaries cannot be persons who, immediately before the time of the eligible transfer of business to the ECT, held, directly or indirectly, alone or with a related person, at least 50% of the shares of the capital stock or debts of the eligible business.

Partager